WHY DO I NEED A PUBLIC ADJUSTER?

RESIDENTIAL CLAIMS

WITH A PUBLIC ADJUSTER

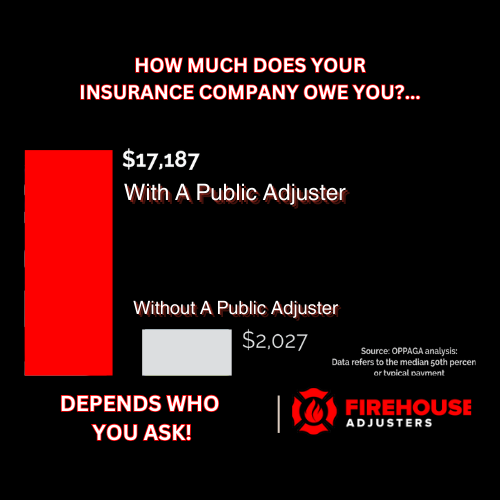

- When you have damage to your property and file an insurance claim, the insurance company will send out an adjuster to put a value on the damages.

- The insurance adjusters will be very conservative in their estimates so that the insurance company saves money.

- To avoid an underpaid or denied claim, property owners use a public adjuster to provide estimates that favor the property owner.

- Your Public Adjuster is on your side and the information gathered from our FREE inspection is used so that the insurance company can not underpay or deny a claim they are required to pay to the insured.

Experiencing a disaster that damages your home is devastating! Having a knowledgeable and caring public adjuster help you with a claim will not only make sure you get what you are owed, but it will ensure there is nothing overlooked and undermined. It just doesn’t make sense to try to manage family, work and mental health on your own through the claims process. Firehouse Adjusters are not only experienced and knowledgeable about insurance claims, we are also firemen with an innate compassion for people. We treat the insurance company professionally and your family with care. The insurance company will see your property and damage from their perspective. Their adjuster will be conservative in assessing your damage and determining what you’re owed to protect the interest of the insurance company. Firehouse Adjusters will represent you and your interests to ensure you get the settlement you are owed.

Firehouse Adjusters will be there from beginning to end working for you! We are experts in evaluating, documenting and negotiating yourinsurance claim to get you the full and fair settlement so you can get back to normal faster!

Your Insurance Claim Settlement: